Fort Myers, Florida Sep 16, 2025 (Issuewire.com) - IRS Failure to Enforce Tax Law in Healthcare Raises Questions of Billions in Lost Revenue

Experts argue that contractual adjustments, the writing off of amounts not paid by the insurance companies, enable providers and insurers to evade lawful tax obligations, with the IRS remaining indifferent.

This report begins with a critical clarification: the contract between the healthcare provider and the insurance company does not change the price of medical services or goods. There is no valid agreement that creates a negotiated fee for those services. Instead, the agreement functions as a mechanism for determining the amount of the kickback the provider pays to the insurance company in exchange for steering insured members to that provider. This foundational point frames the analysis that follows.

The Internal Revenue Service (IRS), long tasked with ensuring that all businesses pay their fair share of taxes, faces mounting criticism for its failure to enforce federal tax law in the healthcare industry. At the center of the controversy is the widespread practice of contractual adjustments, a bookkeeping maneuver that allows hospitals and insurers to write off substantial amounts of billed revenue, reducing reported taxable income.

Despite clear statutory language, Supreme Court precedent, and technical rulings confirming that post-billing write-offs amount to cancellation of debt (COD) income, the IRS has largely failed to act. Observers point to billions of dollars in uncollected tax revenue, unlawful kickback schemes, and systemic price discriminationall under the IRSs watch.

The IRSs Legal Obligations

Under the Internal Revenue Code, accrual-method taxpayers must recognize revenue once the right to collect is fixed and determinable. Healthcare providers, like other businesses, issue bills to patients that create a legal debt enforceable under contract law. Courtsfrom Spring City Foundry (1934) to Ortiz v. State Farm (2009)have reaffirmed that billed amounts are taxable revenue.

Yet hospitals routinely record only the negotiated insurance rate as income, dismissing the balance as a contractual adjustment. By doing so, they sidestep the requirement to report cancellation of debt income, a clear violation of 26 U.S.C. §§ 61 and 451.

IRS Failure of Enforcement

The IRS has repeatedly been presented with evidencethrough whistleblower submissions, Chief Counsel Advice memoranda, and Technical Advice Memoranda such as TAM 200619020that post-billing write-offs are not valid discounts. Instead, they are cancellations of debt. Nonetheless, the agency has failed to pursue audits, enforce penalties, or clarify binding guidance.

Critics argue this neglect has created a two-tier tax system: one in which healthcare giants exploit loopholes with impunity, while ordinary taxpayers are held to strict compliance.

Moreover, by ignoring insurer obligations, the IRS has overlooked the billions in economic value insurers gain by paying below billed charges. Under Kirby Lumber (1931) and Helvering v. American Dental Co. (1943), such relief from liability constitutes taxable income.

Broader Consequences

The IRSs failure has enabled more than tax avoidance. It has fueled price discriminationcharging patients different prices for the same servicesand incentivized illegal steering of patients in violation of the Anti-Kickback Statute and Sherman Act. Patients lose transparency, competition is stifled, and the federal treasury loses revenue at a time of record national debt.

Whistleblowers and legal experts warn that unless the IRS enforces the law equally, public trust in the fairness of the tax system will erode further.

Questions the Public Should Ask Their AI Service

To investigate these issues further, individuals, policymakers, and watchdog groups can leverage AI tools by asking the following targeted questions:

Accrual Accounting & Revenue Recognition

Contracts & Legal Obligations

Contractual Adjustments vs. Cancellations of Debt

Tax Law Compliance & Penalties

Kickbacks, Steering, and Antitrust

IRS Guidance & TAMs

Patient Rights & Legal Enforcement

Sources of Financial Information to Detect Tax Evasion

To uncover schemes of unreported revenue or misclassified debt cancellations in the healthcare industry, it is critical to examine public documents that disclose financial activities. These records provide evidence of revenue, contractual adjustments, and potential tax avoidance. The most valuable sources include:

1. Annual and Quarterly Financial Reports (SEC Filings)

2. IRS Income Tax Returns (Form 990 and Corporate Returns)

3. Medicare and Medicaid Cost Reports

4. State Insurance Department Filings

5. Government Oversight Reports

By systematically reviewing SEC filings, IRS Form 990s, CMS cost reports, and state insurance filings, investigators can trace discrepancies in revenue recognition, contractual adjustments, and debt cancellation. These public records form the evidentiary basis for identifying and proving tax evasion schemes by hospitals and insurance companies.

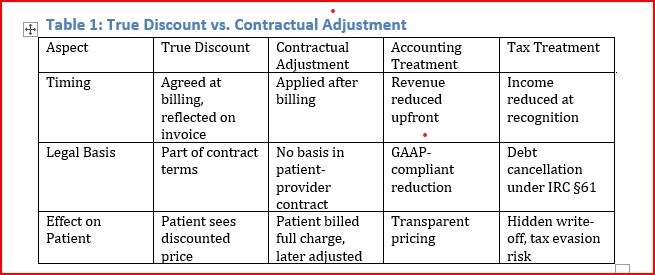

Comparison Table

Table 1 shows that an actual discount is a legitimate price reduction that is agreed upon at the time of billing, clearly reflected on the patients invoice, and treated correctly in both accounting and tax law as reduced revenue. By contrast, a contractual adjustment is applied only after billing, has no basis in the patientprovider contract, and is treated as a hidden write-off. Under GAAP, it reduces reported income, but for tax purposes, it functions as a cancellation of debt under IRC §61. The result is that patients see the full charge, not the real discounted amount, creating the risk of misreporting, concealment, and potential tax evasion.

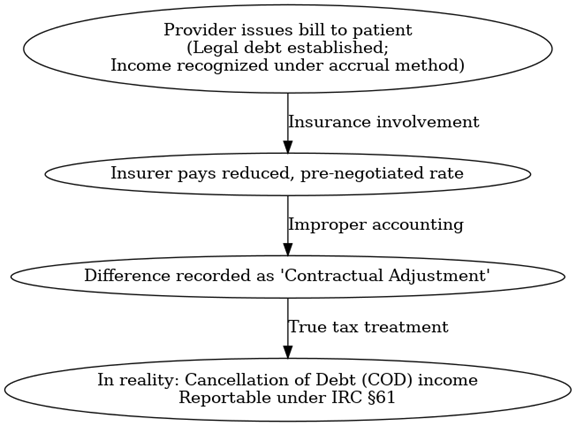

Flowchart: Healthcare Billing and Contractual Adjustment Process

The process begins when the provider issues a bill to the patient. This bill establishes the legal debt and should be recognized as income under the accrual method. If an insurer later pays a reduced, pre-negotiated rate, the difference is improperly recorded as a 'contractual adjustment'. In reality, this is cancellation of debt (COD) income, which must be reported separately under IRC §61.

Conclusion

In conclusion, the evidence demonstrates that the contract between providers and insurance companies does not alter the actual price of medical services or goods, nor does it establish a lawful negotiated fee. Instead, these agreements define the amount of the kickbacks paid by providers to insurers for directing patients to their networks. Recognizing this reality is essential to enforcing tax and antitrust laws, protecting patients, and restoring integrity to the healthcare system.

Media Contact

Saving the World

954-790-9407

14893 American Eagle Ct.

Source :Roy J. Meidinger

This article was originally published by IssueWire. Read the original article here.